Back to School sales tax holiday kicks in on Friday

With the start of a new school year fast approaching, state Rep. Fran Hurley is encouraging parents to take advantage of a state sales tax decrease on school supplies, clothing, shoes and other items over a 10-day period from Aug. 5 through Aug. 14.

“Back-to-school shopping can sometimes be a real hit on a parent’s wallet, particularly with costs rising this year,” Hurley said. “That’s why I supported a tax holiday that will help lower costs and help parents get the supplies they need for their kids.”

Fran Hurley

Starting Aug. 5, the state’s sales tax will drop 5% from 6.25% to 1.25% on common back-to-school items, such as book bags, crayons, pencils, notebooks, pens, scissors, school uniforms and other items students are expected to have. Some exclusions apply. To view a thorough list of applicable items and exclusions, please view the Illinois Department of Revenue’s online bulletin at https://www2.illinois.gov/rev/research/publications/bulletins/Documents/2022/FY%202022-24_N0522.pdf#search=sales%20tax%20holiday.

The sales tax holiday is a part of the Illinois Family Relief Plan, a package of measures supported by Hurley that has suspended state grocery taxes, frozen Illinois’ gas tax and doubled the property tax rebate. The effort also permanently expanded the state’s earned income tax credit, and includes direct income tax rebates for qualifying individuals.

“We want to make sure people know about this tax holiday and are able to take advantage of it,” Hurley said. “Also, please choose to shop local, so that we can support our area businesses and jobs as we begin this new school calendar.”

Included clothing items

The 10-day tax reduction includes clothing items costing less than $125 individually.

Clothing items, as defined by the law, include the standard items such as shorts, pants, skirts, shirts and underwear. The tax reduction will also apply to aprons, hats, caps and earmuffs, coats and jackets, belts and suspenders, rubber pants, lab coats, hosiery, scarves, bathing suits, school uniforms and neckties.

It also applies to footwear – shoes, shoelaces, slippers, insoles, boots, socks and sandals.

Excluded items

But it does not apply to ballet, tap or athletic shoes, roller or ice skates, ski boots, waders, or fins.

Shoppers also should not expect the reduced sales tax rate on accessory items such as briefcases, hair bows, handbags, jewelry, sunglasses or wigs. The reduction also does not apply to sports gloves, goggles, hand and elbow guards, life preservers, wetsuits, shoulder pads, shin guards or mouth guards.

Also excluded are protective equipment items such as breathing masks, hearing protectors, face shields, hard hats and helmets, respirators, protective gloves, safety goggles or tool belts.

Included school supplies

Binders, book bags, calculators, cellophane tape, blackboard chalk, notebooks, erasers, folders, index cards, legal pads, lunch boxes, pencils and sharpeners, supply boxes, protractors, rulers, compasses, and scissors are all eligible for the reduced tax rate.

So are glue, highlighters, markers, crayons and colored pencils.

Excluded items

Shoppers should not expect other art supplies to be eligible for the reduced rate, however. Clay and glaze, paints and paint brushes, sketch pads and drawing pads will all be taxed at the regular 6.25 percent rate.

Textbooks, reference books, maps and globes are all excluded from the “holiday” as well.

Electronics and computers will also be taxed at the regular rate. That includes computers and related supplies such as flash drives, memory cards, data storage, computer cases, cables, printers and ink.

Shoppers also should not expect any breaks while buying cameras, cellphones or handheld electronics.

The task of adjusting the tax rate for individual items will fall on retailers, who collect sales tax and remit it to the state.

Local News

Sorry, we couldn't find any posts. Please try a different search.

Neighbors

State Senate advances bill to ban food additives linked to health problems

By COLE LONGCOR Capitol News Illinois clongcor@capitolnewsillinois.com The Illinois Senate passed a bill Thursday that would ban four food additives that are found in common products including candy, soda and baked goods. Senate Bill 2637, known as the Illinois Food Safety Act, passed on a 37-15 bipartisan vote and will head to the House for…

INVESTIGATE MIDWEST: Farmers have clamored for the Right to Repair for years. It’s getting little traction in John Deere’s home state

By Jennifer Bamberg, Investigate Midwest Originally published April 10, 2024 During the 2023 harvest season, one of Jake Lieb’s tractors quit working. A week later, his combine stopped working, too. Both were new — and he was locked out from making any repairs himself because of software restrictions embedded in the machines. Instead, a technician…

Education leaders seek added state funding to help districts accommodate influx of migrants

By PETER HANCOCK Capitol News Illinois phancock@capitolnewsillinois.com SPRINGFIELD – The recent surge of international migrants arriving in Illinois has brought with it a host of new challenges for state and local officials. Those range from filling their most basic needs like emergency food, clothing and shelter, to more complex issues like lining them up with…

Capitol Briefs: Lawmakers, advocates again call for affordable housing tax credit

By DILPREET RAJU Capitol News Illinois draju@capitolnewsillinois.com Housing advocates are renewing a push to fund a $20 million state affordable housing tax credit in the upcoming state budget. Supporters of the “Build Illinois Homes Tax Credit Act,” modeled after a federal tax credit program, claimed it would result in over 1,000 affordable housing units being…

Solar investments take center stage as questions loom on state’s renewable future

By ANDREW ADAMS Capitol News Illinois aadams@capitolnewsillinois.com BOLINGBROOK – A manufacturer in the southwest suburbs of Chicago received $2.6 million from electric utility Commonwealth Edison this week as part of a state program for generating its own electricity using solar panels and storing it in one of the largest batteries in the country. But even…

Advocates renew push to tighten firearm laws aimed at protecting domestic violence victims

By COLE LONGCOR Capitol News Illinois Clongcor@capitolnewsillinois.com SPRINGFIELD – Advocates for stricter gun laws rallied at the state Capitol Tuesday for a measure aimed at protecting domestic violence victims and two other criminal justice reforms. The bills are backed by organizations such as Moms Demand Action and One Aim Illinois among others. “These policies support…

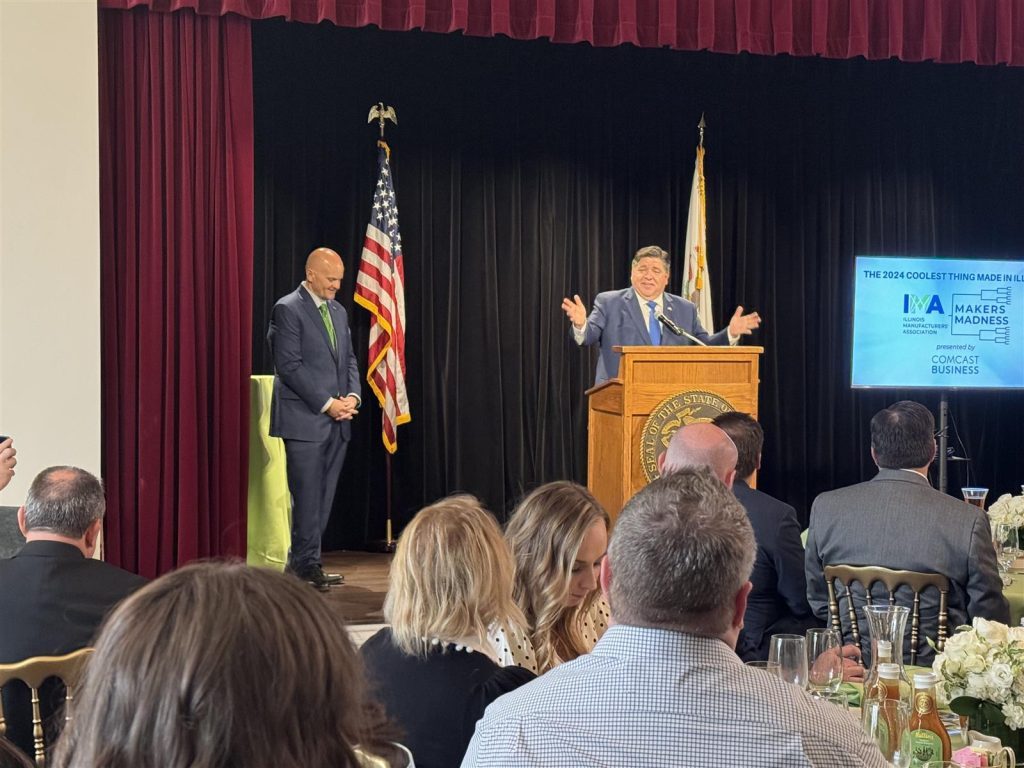

Komatsu mining truck named 2024 ‘coolest thing made in Illinois’

By COLE LONGCOR Capitol News Illinois Clongcor@capitolnewsillinois.com SPRINGFIELD – A mining truck manufactured by Komatsu was crowned the winner of the 2024 “Makers Madness” contest, earning the title of “the coolest thing made in Illinois” at the Governor’s Mansion Wednesday. The truck was one of more than 200 entries in the 5th annual contest hosted…

Capitol Briefs: Pritzker appoints first-ever Prisoner Review Board director; Chicago advances migrant funding

By JERRY NOWICKI & DILPREET RAJU Capitol News Illinois news@capitolnewsillinois.com Weeks after two high-profile resignations at the Illinois Prisoner Review Board, Gov. JB Pritzker on Monday appointed the first-ever executive director to help lead the beleaguered agency. To fill the newly created position, the governor tapped Jim Montgomery, who most recently served as director of…

INVESTIGATE MIDWEST: Farmers have clamored for the Right to Repair for years. It’s getting little traction in John Deere’s home state

By Jennifer Bamberg, Investigate Midwest, Investigate Midwest Originally published April 10, 2024 During the 2023 harvest season, one of Jake Lieb’s tractors quit working. A week later, his combine stopped working, too. Both were new — and he was locked out from making any repairs himself because of software restrictions embedded in the machines. Instead,…

Illinois Senate advances changes to state’s biometric privacy law after business groups split

By HANNAH MEISEL Capitol News Illinois hmeisel@capitolnewsillinois.com SPRINGFIELD – It’s been more than a year since the Illinois Supreme Court “respectfully suggest(ed)” state lawmakers clarify a law that’s led to several multi-million-dollar settlements with tech companies over the collection of Illinoisans’ biometric data. On Thursday, a bipartisan majority in the Illinois Senate did just that,…