Cook County Treasurer Maria Pappas

Pappas: tax investors make millions from black, Latino communities

Study shows homeowners, gov’t losing out on funding

From staff reports

A new study from the Cook County Treasurer’s Office concludes that hedge funds, private equity firms and others are exploiting a loophole in Illinois’ property tax law to make millions of dollars in profits, mostly at the expense of black and Latino communities.

These investors, known as tax buyers, have helped shape the arcane section of the property tax law they now use to their advantage, the report says. They have drained nearly $280 million from Cook County taxing districts over the last seven years. Of that, 87% came from black and Latino communities.

“Investors from all over the country are drawn to our tax sale like it was the California Gold Rush,” Cook County Treasurer Maria Pappas said. “They’re getting rich from struggling communities. The money they make from the law they helped rewrite should be going to schools, parks, police departments and other government agencies.”

Cook County Treasurer Maria Pappas

Tax buyers pay property owners’ delinquent taxes, aiming to make money when the taxpayer repays that debt, at steep interest rates. The tax buyer gets a lien on the properties on which he or she paid the taxes. That lien allows the tax buyer to take properties if taxpayers don’t pay their debt within a specified time period.

But these investors usually do not want to take possession of a property. They have an out: Illinois’ broad and forgiving sale-in-error statute that allows the tax buyers to avoid taking the property and instead get back their investment, often with interest.

Many states have policies that allow tax buyers to get repaid when the government has sold a property it shouldn’t have, including when the property is government-owned or when the taxpayer made good on their debt before the sale.

In Illinois, however, tax buyers can get their money back for “errors” by any county official even when the “errors” would not have prevented a sale or do not cause financial harm to the tax buyer. Tax buyers helped rewrite the property tax law in 1951, allowing them to get their money back for errors they had committed. In 1983, state lawmakers expanded the scope of the law to include errors by county officials, creating a loophole tax buyers have exploited ever since.

The Pappas study cited “frivolous” reasons for which tax buyers got their money back, with interest:

- A house was listed as made of stucco when it was made of brick.

- A two-story commercial building was listed as having 0 square feet of space.

- A home was listed as not having air conditioning when it did.

When a tax sale is undone due to a sale in error, most of the money paid to the tax buyer comes from the revenue of local governments, especially harming cash-strapped black and Latino communities where the majority of tax sales occur, Pappas said.

The Treasurer’s research team surveyed government financial offices in large out-of-state municipalities that sell taxes. None reported having anything like Illinois’ sale-in-error statute. In other states, “buyer beware” was the tax sale motto. Tax buyers must do their own due diligence and assume the risk. No other government granted refunds for government website errors.

“We don’t have that problem, thank goodness,” said Michelle Jones, the Newark, N.J. tax collector, about the frivolous reasons that sales in error are routinely used by tax buyers in Illinois. “That’s ridiculous. You need to amend that. I think they’re taking advantage of you guys.”

Pappas’ study makes many recommendations for state legislative changes, including:

- Changing Illinois law to require tax buyers to prove an error was “material” to the tax sale and they were financially harmed. This would prevent them from profiting from frivolous mistakes.

- Disallowing sales in error for mistakes on the Assessor’s website, given that the Assessor tracks nearly 1.8 million properties, making it impossible to be totally current on the status of each property.

Several county agencies also made errors, including not serving the required taxpayer warnings on time and assigning incorrect addresses to properties. The Treasurer also made recommendations aimed at reducing those errors.

In what she called an extraordinary display of local government transparency and accountability, Pappas ordered her research unit to explore faults in the sale-in-error law, even if part of the problem could be traced back to her office. The research team found that the Treasurer’s Office had erroneously sold the taxes on government-owned properties, scores of which were highways, and on other properties that were tied up in a bankruptcy proceeding at the time of the sale.

Local News

Sorry, we couldn't find any posts. Please try a different search.

Neighbors

Bears pitch $3.2B stadium plan, but Pritzker still ‘skeptical’ despite team’s $2B pledge

By DILPREET RAJU & JERRY NOWICKI Capitol News Illinois news@capitolnewsillinois.com The Chicago Bears laid out a $3.2 billion plan for a new domed stadium on Chicago’s lakefront on Wednesday afternoon, painting pictures of future Super Bowls and other major public events while pinning their hopes on yet-to-be-had conversations with the governor and lawmakers. The Bears…

Regulators weigh future of gas industry in Illinois, while clamping down on Chicago utility

By ANDREW ADAMS Capitol News Illinois aadams@capitolnewsillinois.com CHICAGO – Natural gas is fueling a fight between consumer advocates, a powerful utility company and the state. Amid competing advertising campaigns, accusations of mismanagement and state decarbonization efforts, the Illinois Commerce Commission is starting a process that will shape how the state regulates the increasingly controversial industry. …

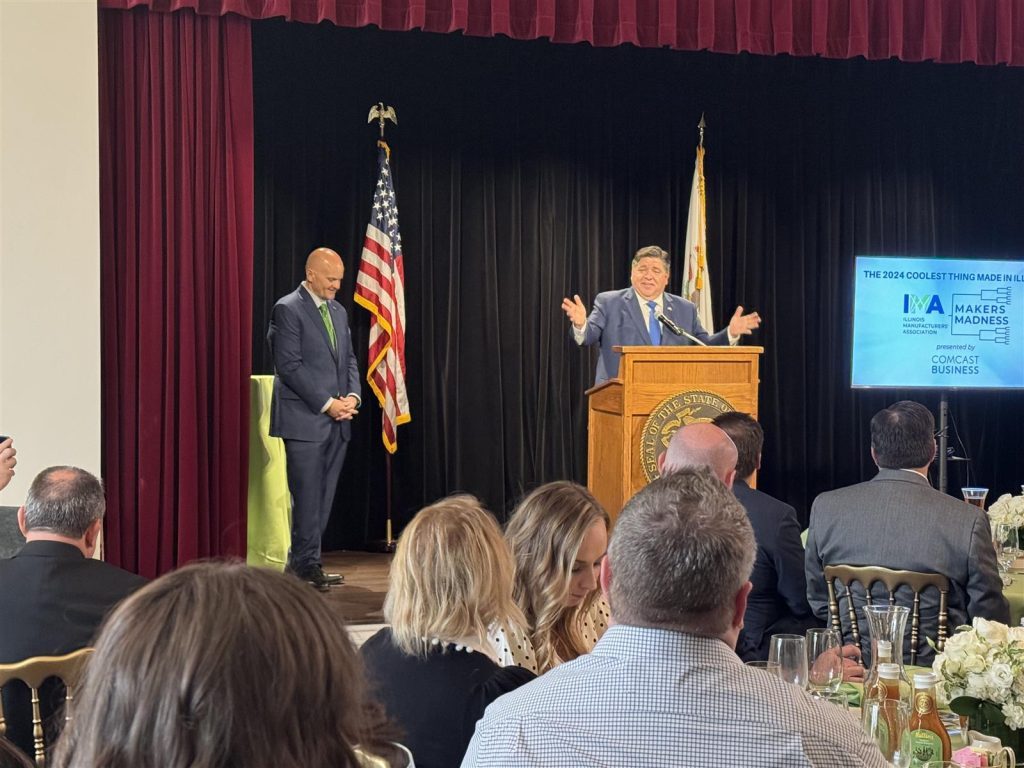

Komatsu mining truck named 2024 ‘coolest thing made in Illinois’

By COLE LONGCOR Capitol News Illinois Clongcor@capitolnewsillinois.com SPRINGFIELD – A mining truck manufactured by Komatsu was crowned the winner of the 2024 “Makers Madness” contest, earning the title of “the coolest thing made in Illinois” at the Governor’s Mansion Wednesday. The truck was one of more than 200 entries in the 5th annual contest hosted…

Giannoulias calls for disclosure of lobbyist contracts

By PETER HANCOCK Capitol News Illinois phancock@capitolnewsillinois.com SPRINGFIELD – For decades, lobbyists in the Illinois Statehouse have been required to report how much they spend wining, dining and entertaining lawmakers. Currently, though, there is no law requiring lobbyists to disclose how much they are paid by corporations, industry groups or other special interest organizations. That…

Illinois Senate advances changes to state’s biometric privacy law after business groups split

By HANNAH MEISEL Capitol News Illinois hmeisel@capitolnewsillinois.com SPRINGFIELD – It’s been more than a year since the Illinois Supreme Court “respectfully suggest(ed)” state lawmakers clarify a law that’s led to several multi-million-dollar settlements with tech companies over the collection of Illinoisans’ biometric data. On Thursday, a bipartisan majority in the Illinois Senate did just that,…

Illinoisans can now get documents notarized online

By ALEX ABBEDUTO Capitol News Illinois abbeduto@capitolnewsillinois.com Illinoisans who need a notary public can now access those services online through a new “E-Notary” portal launched by the secretary of state’s office. This process is one of the latest initiatives of Secretary of State Alexi Giannoulias’ ongoing effort to modernize the office and its services. Notaries…

Prairie Band Potawatomi becomes 1st federally recognized tribe in Illinois

By HANNAH MEISEL Capitol News Illinois hmeisel@capitolnewsillinois.com Nearly 200 years after Native Americans were forced out of Illinois, the Prairie Band Potawatomi Nation has become the first federally recognized tribal nation in the state after a decision from the U.S. Department of the Interior last week. The move represents the first victory in the tribe’s…

Remembering Lee Milner

NEWS TEAM Capitol News Illinois news@capitolnewsillinois.com On Wednesday, April 17, the Springfield, Illinois Capitol and journalism communities lost a devoted friend and advocate when Lee Milner passed away. As Dean Olsen wrote in his piece in the Illinois Times earlier this month, “Readers of Illinois Times often have seen Milner’s work as a freelance photojournalist. But…

Capitol Briefs: Expansion of postpartum coverage, ban on kangaroos among hundreds of measures to pass House

By ALEX ABBEDUTO & COLE LONGCOR Capitol News Illinois news@capitolnewsillinois.com SPRINGFIELD – Illinois kangaroo owners are one step closer to being forced to surrender their marsupials this week after the House passed a bill criminalizing their possession. That was one of more than 300 bills to pass the House ahead of a Friday procedural deadline.…

Pritzker says state ‘obviously’ needs to change 2010 law that shrunk pension benefits

By HANNAH MEISEL Capitol News Illinois hmeisel@capitolnewsillinois.com With a month-and-a-half left in the General Assembly’s spring session, Gov. JB Pritzker’s administration is readying its proposal to address Illinois’ chronically underfunded pension system. But the governor this week also acknowledged in the strongest terms yet that any plans to finally get the state on track toward…