Pritzker: Tax cuts on the table if state revenues continue to exceed expectations

By JERRY NOWICKI

Capitol News Illinois

jnowicki@capitolnewsillinois.com

SPRINGFIELD – With two months to go before the legislature adjourns and current-year revenues continuing to smash expectations, Gov. JB Pritzker said he and legislative leaders are considering tax cuts.

His comments came one week after the legislature’s nonpartisan Commission on Government Forecasting and Accountability, or COGFA, increased its revenue estimates by about $1 billion for the current and upcoming budget years combined.

“I would like to see – as we feel comfortable with these new revenues coming in and their stability; and I think we’re seeing a few years in a row now of the stability of that revenue – that we should be talking about whether there are tax cuts that we can implement,” he said at an unrelated news conference at a Springfield community college.

The governor did not say whether tax cuts would be permanent or which taxes he and lawmakers are considering cutting. And tax cuts were one of several potential uses of excess revenues the governor said he would like to consider. Others include contributions to the state’s “rainy day” fund and added payments beyond required amounts to the state’s pension system.

The conversation about what to do with excess revenues that show year-over-year stability is one Pritzker said has involved both Democrats and Republicans.

House Minority Leader Tony McCombie, R-Savanna, told Capitol News Illinois in a statement that the House GOP stands ready to work with the governor.

“To hear the governor mention any tax cuts is an exciting prospect for families across our state. At the first meeting I had with Gov. Pritzker, we discussed the cumbersome franchise tax on small businesses and high estate taxes that unfairly target family farms,” she said. “The governor recognizing conversations with Democrats and Republicans gives me hope that we will reinstitute the bipartisan budget working group with our budgeteers and appropriation teams leading the way.”

McCombie also noted the House Republicans oppose a graduated income tax, which Pritzker has said he has no interest in reviving as a legislative proposal this year.

Senate Minority Leader John Curran, R-Downers Grove, referred to business-related tax incentives that Pritzker and lawmakers approved on bipartisan lines in 2019 but which Democrats froze in future budget years.

“Initial discussions on tax relief have been receptive,” Curran said in a statement. “We will continue to call for implementing the business incentives that the governor agreed to in the Blue Collar Jobs Act, along with additional tax relief for Illinois families and small businesses.”

He said the Senate GOP is hopeful Pritzker will “include Republicans at the table of substantive budget meetings,” and they are “willing to negotiate in good faith.”

In their budget approved last summer for the current fiscal year, lawmakers included an array of mostly temporary tax relief. That included direct checks of $50 or more to most Illinoisans depending on income and number of children, a permanent expansion of the state’s earned income tax credit to 20 percent of the federal credit, a six-month pause on a 2-cent gas tax increase that ended Jan. 1, a one-year suspension of the state’s 1 percent grocery tax that ends June 30, and a property tax rebate up to $300 for some Illinoisans.

The governor’s office estimated those measures amounted to about $1.8 billion in tax relief overall. The state approved legislation bringing its rainy day fund balance to an estimated $1.9 billion by the end of the fiscal year and contributing $500 million beyond statutory requirements to its pension fund over the past two years.

The revenue update announced by COGFA last week represents just the latest in a remarkable stretch for state government revenues that have boomed nationwide over the course of the past two years. In Illinois, the growth has been driven by wage growth, corporate profits, inflation, changes to the corporate and online sales tax structures, revenues from marijuana sales and other factors.

“You can see in every single month so far this fiscal year we’ve actually had a gain where we’ve generated more revenue in this fiscal year compared to the same time a year ago,” Eric Noggle, senior revenue analyst for COGFA, said at the commission’s March meeting last week.

COGFA’s new estimate of $51.9 billion in revenues for the current fiscal year that ends June 30 is $545 million beyond the amount assumed by the Governor’s Office of Management and Budget in Pritzker’s budget proposal. And its $50.4 billion estimate for the fiscal year that begins July 1 is $465 million beyond GOMB’s initial estimate.

All told, COGFA now expects the state to end the fiscal year with revenues surpassing their initial estimates by more than $5 billion. While that’s partially because base sales and income tax receipts continue to produce at record levels, it’s also because the state’s estimates approved last summer were conservative, Pritzker said.

The current fiscal year still has three and a half months left, so COGFA noted in its recent report that the revenue estimate could be bumped even higher if final income tax receipts are stronger than expected as taxpayers file their returns for the year.

But it could also move downward, the commission noted, if those revenues come in lower than expected due to weakening market conditions. They noted other factors could change the state’s revenue outlook, including the possibility of another COVID-19 resurgence, a worsening of the war in Ukraine, or a potential recession.

Capitol News Illinois is a nonprofit, nonpartisan news service covering state government and distributed to more than 400 newspapers statewide. It is funded primarily by the Illinois Press Foundation and the Robert R. McCormick Foundation.

Local News

Donate teddy bears to our local police

Spread the love. Peggy Zabicki Your correspondent in West Lawn 3633 W. 60th Place • (773) 504-9327 . Have you ever seen the 1955 movie The Night of the Hunter? The children in this movie show such bravery and acceptance in what life has thrown at them. They have to deal with unimaginable events and sadness. …

Boy Scouts collecting tattered flags for disposal

Spread the love. By Mary Stanek Your correspondent in Archer Heights and West Elsdon 3808 W. 57th Place • (773) 517-7796 . Goodbye April, hello May. Our American Flag, the symbol of our country, should always be treated with respect. But after bearing Chicago’s brutal winters and hot blazing summers along with being in the…

Oak Lawn trustee says village needs state grocery tax

Spread the loveBy Joe Boyle An Oak Lawn trustee said that Gov. J.B. Pritzker’s proposal to eliminate the state’s grocery tax will be costly for the village. Trustee William “Bud” Stalker (5th), accompanied by Mayor Terry Vorderer, recently returned from a fact-finding trip to Springfield where they learned more about the governor’s proposal to eliminate…

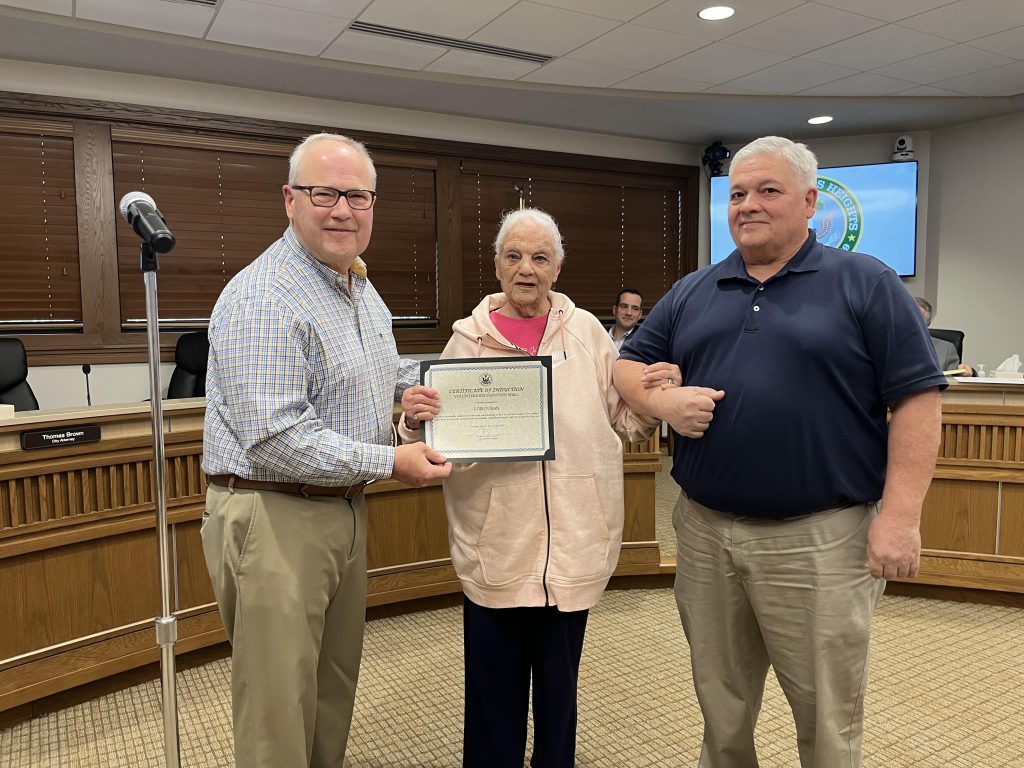

Palos Heights recognizes volunteers

Spread the loveBy Nuha Abdessalam Palos Heights handed out awards last week recognizing the services provided by volunteers through the years. The proclamations, which were read aloud during the city council meeting April 16, were a testament to the city’s volunteers and were handed out as part of Volunteer Recognition Week. Volunteers were cited for…

Boys Volleyball | Richards weathering struggles after run of success

Spread the loveBy Xavier Sanchez Correspondent After a tough weekend at the Smack Attack tournament, Richards got back into the win column with a two-set victory over Eisenhower in a South Suburban Red match. The Bulldogs made quick work of the Cardinals, winning 25-16, 25-15 on April 23 in Oak Lawn to snap a five-match…

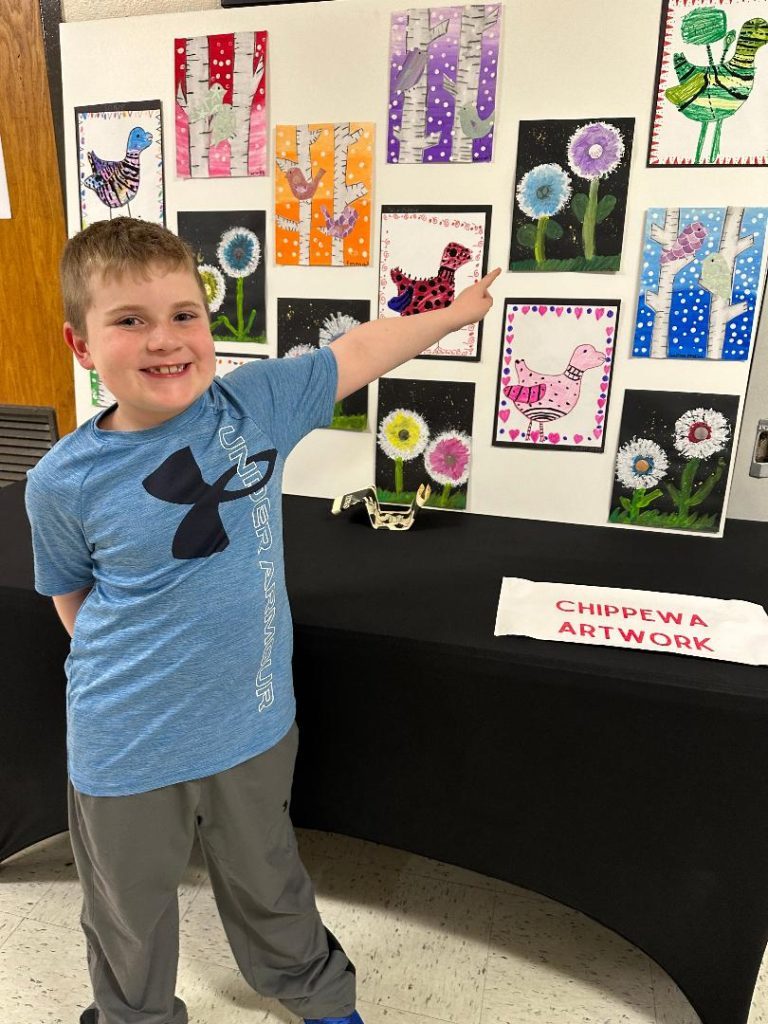

SD218 puts on annual Arts Extravaganza

Spread the loveBy Kelly White The arts have become a major portion of the curriculum Community High School District 218. Showcasing those many talents, the Friends of CHSD 218’s Education Foundation proudly hosted its 15th annual Arts Extravaganza on April 5 at Eisenhower High School in Blue Island. “The Arts Extravaganza is a great event…

Gaming licenses to be tougher to get in Orland Park

Spread the loveBy Jeff Vorva It’s going to take longer to receive gaming licenses in Orland Park. The village board passed an ordinance April 15 that would allow table service businesses open at least 36 consecutive months to apply rather than the previous 18 months, and extended the probationary period to 18 months instead of…

Palos Park passes $16 million budget

Spread the loveBy Jeff Vorva The Palos Park Village Council approved the 2024-25 budget, which totals a little more than $16.3 million at the April 22 village council meeting. According to village documents, it represented an increase of a shade over $603,000 from last year. The village is expecting $13.4 million in revenue and $1.86…

Fire damages Al Bahaar Restaurant in Orland Park

Spread the loveFrom staff reports Orland Fire Protection District firefighters responded to a fire Monday evening at the Al Bahaar Restaurant, 39 Orland Square Dr. At first, restaurant owners suspected the fire alarm was triggered by a malfunction, but as firefighters inspected the restaurant to reset the fire alarm, they detected a burning smell. “What…

Neighbors

Sorry, we couldn't find any posts. Please try a different search.