Local News

Bridgeview approves auto repair shop

Moves up time for May 1 village board meeting By Steve Metsch Bridgeview is getting a new automotive repair shop. The village board at its April 17 matinee meeting approved a special use permit that will allow a repair shop at 9010 S. Beloit Ave. There was no discussion among trustees. The board followed the…

Summit Fire Department blood drive draws a crowd

By Carol McGowan The Summit Fire Department, along with the Village of Summit, and the Argo Summit Lions Club held a blood drive this past Saturday, and it drew a crowd that even impressed the American Red Cross. It took place from 9 a.m. until 2 p.m. with non-stop donors walking through the door. Fire…

Hodgkins toasts village businesses

By Carol McGowan Hodgkins Mayor Ernest Millsap and the Board of Trustees celebrated the village’s businesses at its annual Business Appreciation Breakfast on April 10. Over 100 people gathered at the Hodgkins Administration Center for a hearty breakfast hosted by the village. Representatives from many businesses that are located in or that work within the…

First Secure Bank to host American Eagle gold coin sale

From staff reports First Secure Bank & Trust of Palos Hills announced its annual May sale of 1-ounce and ¼-ounce American Eagle Gold Coins, produced by the U.S. Mint, will take place from 10 a.m.to noon on Saturdays, May 4, May 11, May 18 and May 25. The sale will take place at First Secure…

Oak Lawn trustee says village needs state grocery tax

By Joe Boyle An Oak Lawn trustee said that Gov. J.B. Pritzker’s proposal to eliminate the state’s grocery tax will be costly for the village. Trustee William “Bud” Stalker (5th), accompanied by Mayor Terry Vorderer, recently returned from a fact-finding trip to Springfield where they learned more about the governor’s proposal to eliminate the grocery…

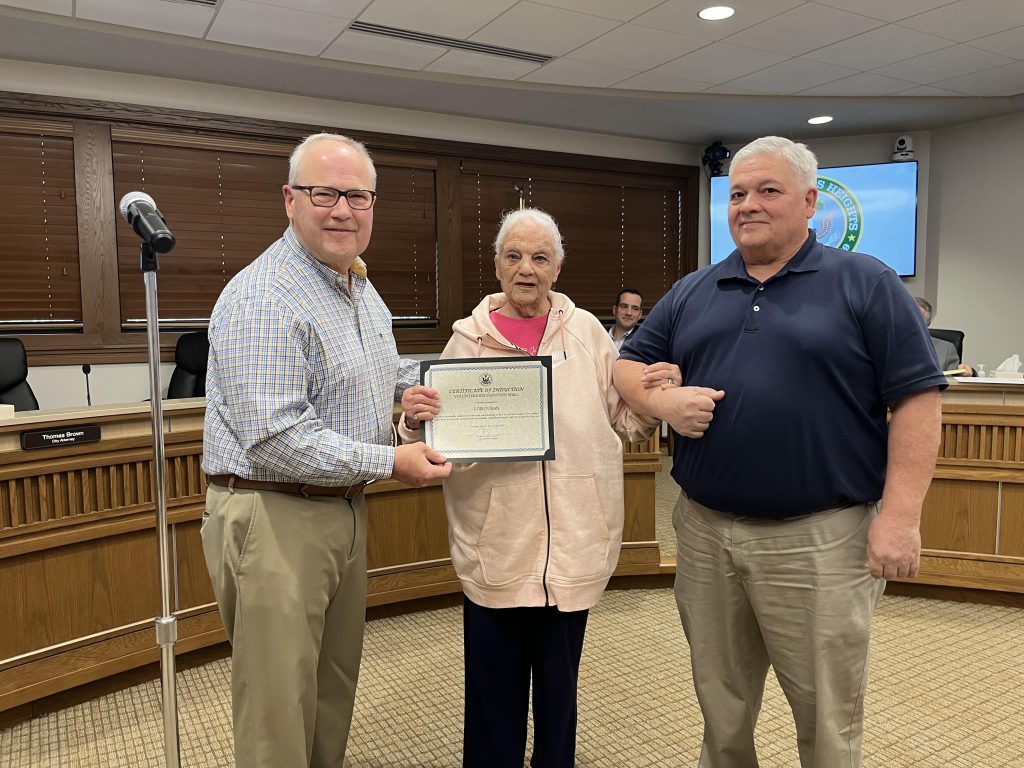

Palos Heights recognizes volunteers

By Nuha Abdessalam Palos Heights handed out awards last week recognizing the services provided by volunteers through the years. The proclamations, which were read aloud during the city council meeting April 16, were a testament to the city’s volunteers and were handed out as part of Volunteer Recognition Week. Volunteers were cited for their efforts…

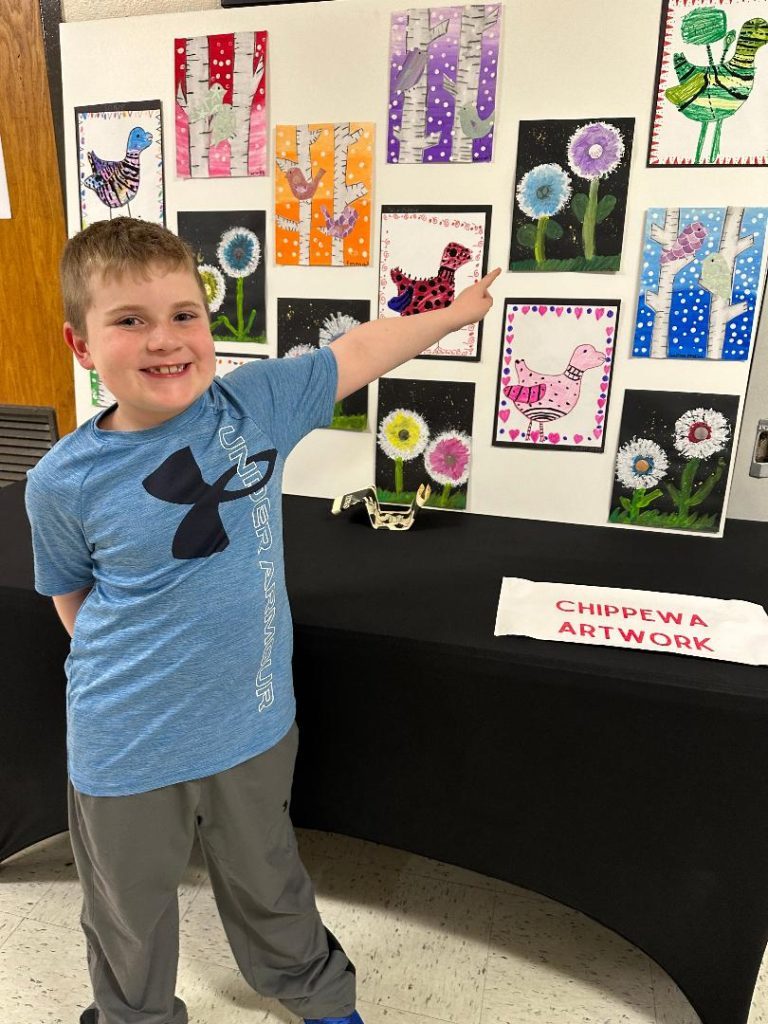

SD218 puts on annual Arts Extravaganza

By Kelly White The arts have become a major portion of the curriculum Community High School District 218. Showcasing those many talents, the Friends of CHSD 218’s Education Foundation proudly hosted its 15th annual Arts Extravaganza on April 5 at Eisenhower High School in Blue Island. “The Arts Extravaganza is a great event which showcases…

Palos Park passes $16 million budget

By Jeff Vorva The Palos Park Village Council approved the 2024-25 budget, which totals a little more than $16.3 million at the April 22 village council meeting. According to village documents, it represented an increase of a shade over $603,000 from last year. The village is expecting $13.4 million in revenue and $1.86 million in…

Fire damages Al Bahaar Restaurant in Orland Park

From staff reports Orland Fire Protection District firefighters responded to a fire Monday evening at the Al Bahaar Restaurant, 39 Orland Square Dr. At first, restaurant owners suspected the fire alarm was triggered by a malfunction, but as firefighters inspected the restaurant to reset the fire alarm, they detected a burning smell. “What we found…

‘Brazen and cowardly’: Police, community outraged by officer’s slaying

. By Tim Hadac Police and others across the Southwest Side reacted with outrage this week over the slaying of a Chicago Police officer in the early morning hours on Sunday. Officer Luis M. Huesca was shot to death on the street in the 3100 block of West 56th Street at 2:53 a.m. April 21.…

Pols want 63rd St. armory for new police HQ

. Porfirio, Guerrero-Cuellar push plan in Springfield . By Tim Hadac Any plans the Chicago Department of Aviation may have had for the vacant Army National Guard Midway Armory, 5400 W. 63rd St., may be grounded, at least for now. Several elected officials are eyeing the parcel as the headquarters of a new police district,…

Her back against the wall, Stacy needs help

. By Tim Hadac Editor Clear-Ridge Reporter & NewsHound (708)-496-0265 . Clearing and Garfield Ridge have earned a reputation as a place where people look out for each other—and that sometimes means caring for each other in times of need. Today, I want to talk about one such person, who sure could use a boost…

It’s (pizza) party time at OLS

. Third graders at Our Lady of the Snows School break into cheers as they learn they’ve won a pizza party for selling more raffle booklets than any other class. The recent Grand Raffle fundraiser brought in about $6,000. Parents looking for a grade school for their sons and daughters for 2024-25 are welcome to…

Dart wants free mental health care for first responders

. From staff reports The Illinois Senate has passed legislation proposed by Cook County Sheriff Thomas J. Dart that eliminates out-of-pocket expenses for first responders seeking mental health treatment. “We ask first responders to be constantly exposed to traumatic and dangerous situations to protect us,” Dart said. “This legislation is a solid step toward helping…

Volunteers give Palos Heights a spring cleaning

By Kelly White Palos Heights works hard to keep its city beautiful. Gathering residents together for a day of cleaning and fun was the Palos Heights Green Team with a Clean Up Day on April 13. “This event invited everyone in our community to do their part in combating pollution by having a fun morning…

Hunt man who tried to rob Chase Bank

. FBI looking for tips from public . From staff reports FBI officials are appealing to the public for help in finding a man who attempted to rob a Southwest Side bank branch. The bandit tried to rob the Chase Bank branch at 5687 S. Archer (just west of Laramie) at about 11 a.m. Wednesday,…

Casten lauds Biden for ‘clean energy’ move

. From staff reports A move designed to spur the responsible development of clean energy on America’s public lands was recently lauded by U.S. Rep. Sean Casten (D-6th). The congressman, co-chairman of the House Sustainable Energy and Environment Coalition (SEEC) Clean Energy Deployment Task Force, joined by co-chairman Mike Levin (D-Calif.), released a statement in…

E-Notary makes things easier, Giannoulias says

. From staff reports Illinois residents will no longer have to notarize documents in person under a new Electronic-Notary system administered by Secretary of State Alexi Giannoulias’ office. Electronic Notarization, or “E-Notary,” will radically change the way people and use notary services, Giannoulias predicted. Without leaving the home or office, an individual or business can…

Oak Lawn honor Fire and Public Safety Contest winners

By Joe Boyle The Oak Lawn Chamber of Commerce presented awards to the winners of the 2023 Fire and Public Safety Coloring Book Contest at the Oak Lawn Village Board meeting on April 9. Fire Bureau Chief David Wheeler and Police Chief Daniel Vittoro were on hand to present the plaques, along with Oak Lawn Mayor…

Illinois News

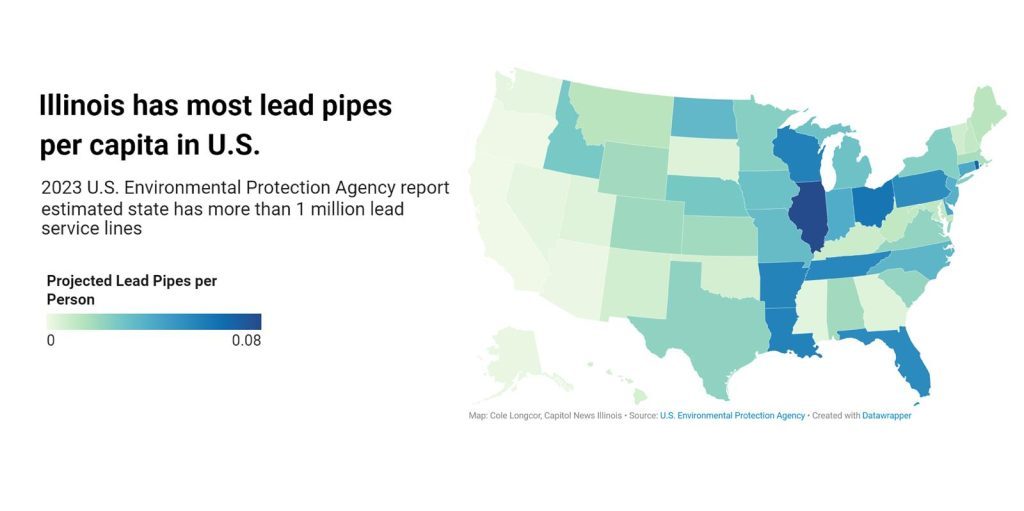

As state continues to inventory lead pipes, full replacement deadlines are decades away

By COLE LONGCOR Capitol News Illinois Clongcor@capitolnewsillinois.com Lead pipes in public water systems and drinking fixtures have been banned in new construction since 1986, when Congress amended the Safe Drinking Water Act, but they are still in use across the U.S. and in Illinois. The presence of lead pipes has persisted due in part to…

Capitol Briefs: State unveils report on racial disparities among homeless populations

By ANDREW ADAMS Capitol News Illinois aadams@capitolnewsillinois.com Tackling homelessness requires addressing racial injustice, according to a new report commissioned by the state’s Office to Prevent and End Homelessness. The report found that Black people are eight times more likely to experience homelessness than white people. Remedying this disparity, according to the report, would require “long-term…

Flooding is Illinois’ Most Threatening Natural Disaster. Are We Prepared?

by Meredith Newman, Illinois Answers Project April 16, 2024 This story was originally published by the Illinois Answers Project. The electricity in Mary Buchanan’s home in West Garfield Park was not working – again. The outage lasted four days, starting just after a crew dug up her front lawn to install a check valve in…

Bears pitch $3.2B stadium plan, but Pritzker still ‘skeptical’ despite team’s $2B pledge

By DILPREET RAJU & JERRY NOWICKI Capitol News Illinois news@capitolnewsillinois.com The Chicago Bears laid out a $3.2 billion plan for a new domed stadium on Chicago’s lakefront on Wednesday afternoon, painting pictures of future Super Bowls and other major public events while pinning their hopes on yet-to-be-had conversations with the governor and lawmakers. The Bears…

Regulators weigh future of gas industry in Illinois, while clamping down on Chicago utility

By ANDREW ADAMS Capitol News Illinois aadams@capitolnewsillinois.com CHICAGO – Natural gas is fueling a fight between consumer advocates, a powerful utility company and the state. Amid competing advertising campaigns, accusations of mismanagement and state decarbonization efforts, the Illinois Commerce Commission is starting a process that will shape how the state regulates the increasingly controversial industry. …

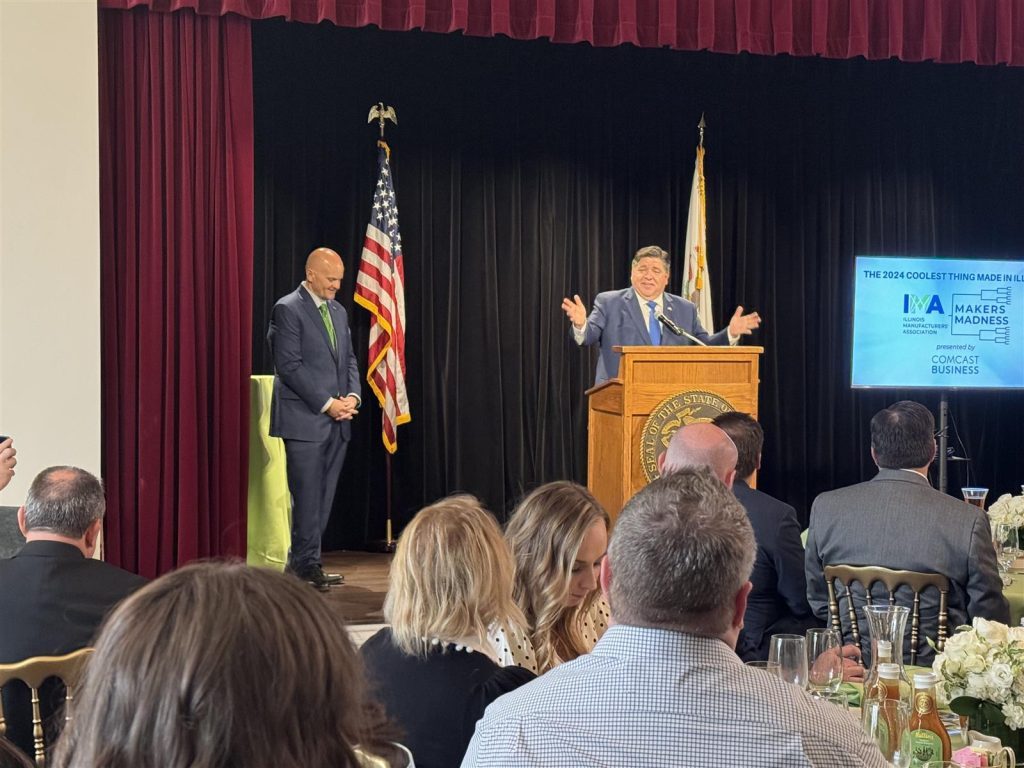

Komatsu mining truck named 2024 ‘coolest thing made in Illinois’

By COLE LONGCOR Capitol News Illinois Clongcor@capitolnewsillinois.com SPRINGFIELD – A mining truck manufactured by Komatsu was crowned the winner of the 2024 “Makers Madness” contest, earning the title of “the coolest thing made in Illinois” at the Governor’s Mansion Wednesday. The truck was one of more than 200 entries in the 5th annual contest hosted…

Giannoulias calls for disclosure of lobbyist contracts

By PETER HANCOCK Capitol News Illinois phancock@capitolnewsillinois.com SPRINGFIELD – For decades, lobbyists in the Illinois Statehouse have been required to report how much they spend wining, dining and entertaining lawmakers. Currently, though, there is no law requiring lobbyists to disclose how much they are paid by corporations, industry groups or other special interest organizations. That…

Illinois Senate advances changes to state’s biometric privacy law after business groups split

By HANNAH MEISEL Capitol News Illinois hmeisel@capitolnewsillinois.com SPRINGFIELD – It’s been more than a year since the Illinois Supreme Court “respectfully suggest(ed)” state lawmakers clarify a law that’s led to several multi-million-dollar settlements with tech companies over the collection of Illinoisans’ biometric data. On Thursday, a bipartisan majority in the Illinois Senate did just that,…

Illinoisans can now get documents notarized online

By ALEX ABBEDUTO Capitol News Illinois abbeduto@capitolnewsillinois.com Illinoisans who need a notary public can now access those services online through a new “E-Notary” portal launched by the secretary of state’s office. This process is one of the latest initiatives of Secretary of State Alexi Giannoulias’ ongoing effort to modernize the office and its services. Notaries…

Prairie Band Potawatomi becomes 1st federally recognized tribe in Illinois

By HANNAH MEISEL Capitol News Illinois hmeisel@capitolnewsillinois.com Nearly 200 years after Native Americans were forced out of Illinois, the Prairie Band Potawatomi Nation has become the first federally recognized tribal nation in the state after a decision from the U.S. Department of the Interior last week. The move represents the first victory in the tribe’s…